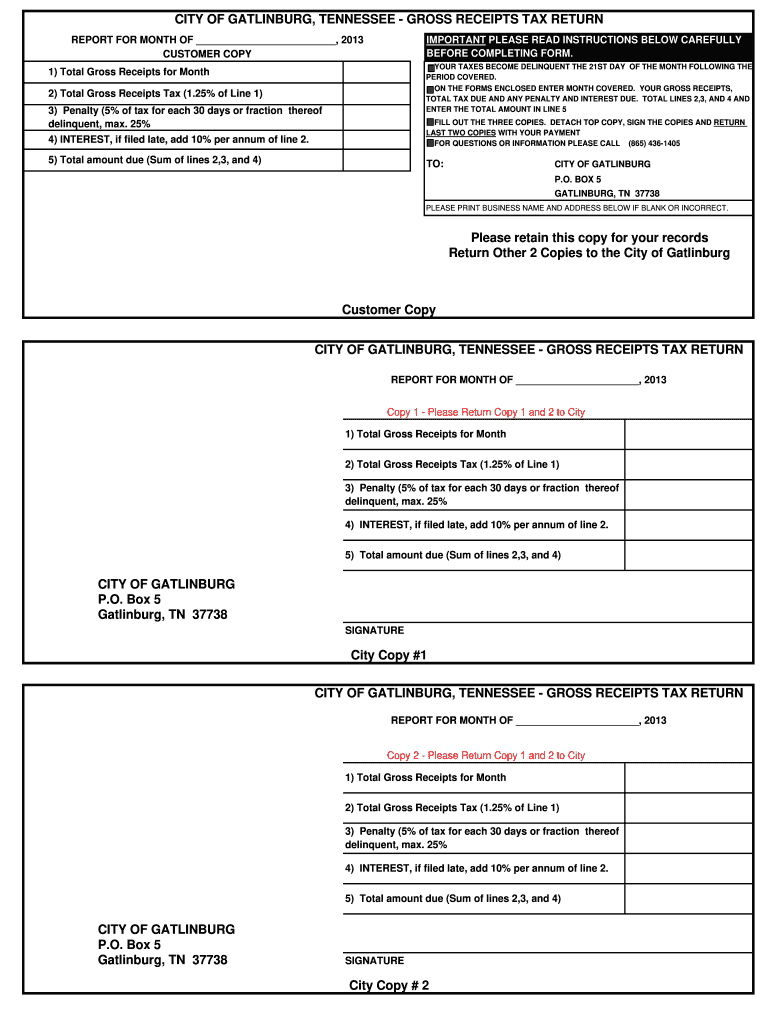

Apportionment: Determination of the proper manner in which to source sales, payroll and property to the various taxing jurisdictions.Tax Recovery Reviews: Review of past filings to determine where your company may be paying more tax than is required.Tax Amnesty/Voluntary Disclosures: Agreements with tax jurisdictions to give your company a means to settle past state and/or local tax exposures.Nexus Studies: Determination of the jurisdictions where your company must file tax returns.Some of the specific areas in which our SALT professionals can assist include: Strategic Consulting

Additionally, our SALT professionals work with clients to recover overpaid income and gross receipts taxes, assist with the preparation of annual tax return obligations or other compliance, and identify and implement planning that impacts the overall state income tax posture of companies. Our state and local tax (SALT) professionals work with business owners, finance professionals or tax department professionals to educate, advise and assist them in understanding and planning for the effects of operations on state income and gross receipts taxes. That leads to many, many vagaries and complexities.įor many companies, a large percentage of their overall income tax liability is attributable to state and local income and gross receipts based taxes.Īndersen takes a strategic approach to helping clients manage the complexities of state income, franchise and gross receipts tax. The only limitations to their ability to tax are the U.S. There are no bright-line limits to their ability to tax or to the amount of tax they can require. Each state has the ability to impose taxes, and all of the states exercise that right. Commercial Reorganization and BankruptcyĬonducting business in a multistate environment can be challenging from many perspectives, but especially from the state and local tax perspective.Valuation Services for Businesses Close Link.Valuation Services for Private Clients Close Link.Valuation Services for Alternative Investment Funds Individuals & Families with International WealthĪccounting Services for Closely-Held Businesses

0 kommentar(er)

0 kommentar(er)